From Short-Video to Community Commerce: How Chinese Platforms Are Redefining Digital Engagement

China’s social media ecosystem is a masterclass in rapid evolution, and its latest transformation has reshaped the rules of digital commerce: community commerce — a seamless fusion of social interaction, user identity, and purchase intent that turns passive content consumption into active brand participation. Short videos remain the cornerstone of user attention, but they have evolved from mere entertainment tools into gateways for deep, community-driven commercial engagement.

For international marketers, understanding this shift is not just advantageous — it’s imperative. In a market where 90% of consumers rely on social recommendations for purchasing decisions (per China Internet Network Information Center data), ignoring the community commerce revolution means missing the chance to connect with 1.1 billion active mobile internet users.

The Rise of Community Commerce: From Transaction to Tribal Belonging

Community commerce represents the natural maturation of content marketing in China, shifting the paradigm from “selling products” to “cultivating communities.” This evolution responds to a critical market shift: Chinese consumers, increasingly weary of overt sales tactics, now prioritize value, authenticity, and emotional connection over hard sells.

Platforms have strategically engineered this transition:

- On Xiaohongshu (RED), users share unfiltered, real-life product experiences that outperform traditional ads by 3x in engagement rates.

- On Douyin, creators transform product promotions into relatable micro-dramas or lifestyle snippets, with story-driven content boasting 2.5x higher conversion than direct sales pitches.

- On WeChat, brands leverage mini-programs and WeCom to nurture long-term relationships, turning one-time buyers into repeat customers with 70% higher retention rates.

In essence, modern Chinese commerce thrives on storytelling — not salesmanship. Brands that succeed are those that position themselves as part of a community, not just purveyors of goods.

Douyin: From Short-Video Pioneer to Social Commerce Powerhouse

No platform exemplifies this evolution more vividly than Douyin (China’s TikTok equivalent), which has transformed from a short-video app into a full-fledged social commerce ecosystem with 780 million daily active users (DAU) in 2025.

1. Short-Video as the Discovery Engine

Douyin’s algorithm remains unmatched in surfacing hyper-relevant content: beauty routines, meal preps, small business success stories — not polished ads. This organic discovery drives 60% of product awareness for fast-moving consumer goods (FMCG) brands in China, making it the top channel for new product launches.

2. Mini-Dramas + Livestream: Engagement Reimagined

The 2024–2025 breakout trend — mini-dramas — has redefined brand integration. These serialized, 1–3 minute storylines subtly weave in products (e.g., a character using a skincare brand during a plot twist) while building emotional connection with viewers. When paired with livestream Q&As or limited-time offers, mini-dramas drive conversion rates 4x higher than standard product videos. Brands like L’Oréal and Xiaomi have reported 30%+ sales growth from mini-drama campaigns.

3. Seamless Commerce Integration

Douyin’s closed-loop ecosystem eliminates friction: internal shop links, one-click checkout, and AI-powered product recommendations keep users within the app from discovery to purchase. This seamless flow has made Douyin the second-largest e-commerce platform in China, with 2025 GMV (gross merchandise volume) projected to exceed 3 trillion RMB.

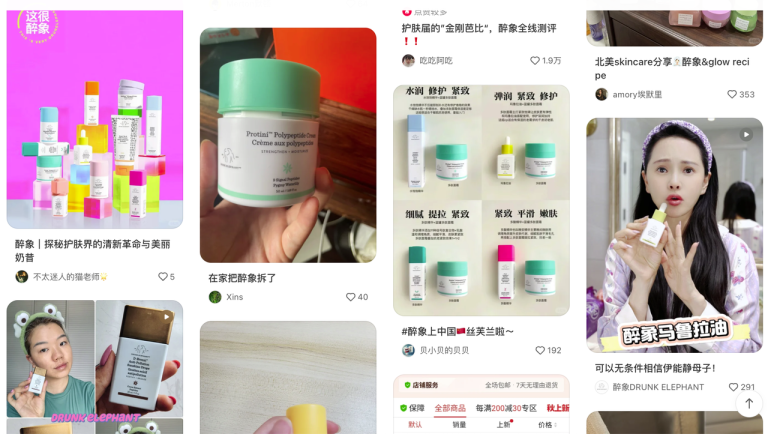

Xiaohongshu: Trust as the Foundation of Purchase Decisions

If Douyin is about discovery, Xiaohongshu (RED) is about trust — a critical currency in Chinese e-commerce. With 260 million DAU, the platform has evolved from a lifestyle sharing app to a “consumer decision engine” where peer recommendations carry more weight than celebrity endorsements.

1. User-Generated Content (UGC) as Brand Truth

Xiaohongshu’s DNA is built on authenticity: 85% of users trust UGC reviews over brand-produced content. A single honest review from a “regular user” can generate 10x more engagement than a celebrity ad, as seen in the 2024 viral success of a small herbal tea brand that gained 100k customers from a single Xiaohongshu user’s “postpartum recovery” diary. Today, brands treat Xiaohongshu as both a search engine (60% of users use it to research products) and a community hub, investing in UGC campaigns to foster organic advocacy.

2. Niche Communities: The New Battlefield for Relevance

2025 has seen explosive growth in micro-communities, each with its own language, aesthetics, and influence networks:

- “Clean beauty” and “zero-waste lifestyle” circles (12 million+ active users) prioritize sustainability and ingredient transparency.

- “Study with me” communities (8 million+ users) drive demand for productivity tools and educational products.

- “Expat life in China” and “mum sharing” groups (5 million+ users each) seek tailored solutions for specific life stages.

Brands that succeed on Xiaohongshu don’t just post content — they speak the language of these niches, partnering with micro-influencers (10k–100k followers) who embody the community’s values.

WeChat & WeCom: The Private Domain Core of Retention

While Douyin and Xiaohongshu drive awareness, WeChat (1.3 billion MAU) and WeCom (250 million MAU) form the backbone of private domain operations (私域) — the secret to long-term conversion and retention in China.

1. Private Traffic: Beyond Traditional CRM

Chinese brands have redefined customer relationship management through private domain: using WeCom, brands establish direct 1-to-1 communication with customers, create exclusive group chats, and offer personalized membership rewards. This approach boosts customer lifetime value (CLV) by 50% on average, as seen in luxury brand Hermès’ WeCom groups, where members receive early access to limited editions and personalized styling advice.

2. Ecosystem Synergy: A End-to-End Customer Journey

WeChat’s integrated tools create a seamless path from awareness to loyalty:

- Mini-programs enable direct purchases, loyalty point tracking, and offline store check-ins (used by 70% of major brands in China).

- WeCom facilitates post-purchase follow-up, with brand representatives resolving issues and sharing tailored offers.

- WeChat Channels now competes with Douyin in lifestyle video content, allowing brands to extend their reach within the same ecosystem.

This closed loop ensures that customers never have to leave the WeChat universe — a critical advantage in a market where app-switching reduces conversion by 40%.

AI + Data: The Engine of Emotional Resonance

In 2025, successful content creation in China is a hybrid of human creativity and AI-powered precision. Brands are leveraging technology not just to analyze behavior, but to anticipate emotional needs.

1. AI-Driven Market Insights

Brands use AI tools to:

- Track trending hashtags and topics in real time (e.g., identifying a surge in “nostalgic 90s snacks” on Xiaohongshu).

- Identify high-potential micro-KOLs by analyzing engagement quality (not just follower count).

- Personalize content tone for regional audiences (e.g., more playful language for Gen Z in Guangzhou, more sophisticated messaging for professionals in Beijing).

2. Data-Powered Emotional Storytelling

The most effective campaigns don’t just track clicks — they map emotional responses. AI tools analyze user comments, facial recognition in livestreams, and social listening data to identify feelings like joy, nostalgia, or belonging. For example:

- A fragrance brand used AI to detect a spike in “first love memories” posts on Xiaohongshu, then launched a campaign featuring user-generated stories about “scents that remind me of my youth,” driving a 28% increase in sales.

- A home appliance brand analyzed emotional triggers for “family warmth” and created mini-dramas about intergenerational bonding, resulting in 50% higher brand recall.

Key Takeaways for Global Brands

- Mobile-First, Ecosystem-Centric: Unlike Western platforms where social and commerce are siloed, China’s digital ecosystem unifies content, communication, and shopping into a single mobile experience. Brands must design strategies for this closed loop, not just individual platforms.

- Influence = Trust, Not Reach: Micro-influencers and private community leaders drive more conversions than A-list celebrities. Focus on building authentic relationships with niche audiences, not chasing mass reach.

- Localization = Emotional Adaptation: Success isn’t about translating content — it’s about understanding cultural nuances. For example, emphasizing “family” and “community” resonates more than individualism, while nostalgia for 90s and 00s culture is a powerful trigger for Gen Z and millennials.

- Private Domain Is Non-Negotiable: Invest in WeChat/WeCom operations to nurture long-term relationships. In China, customer retention is as important as acquisition — private domain drives 60% of repeat purchases for leading brands.

Conclusion: Belonging Is the New Currency of Commerce

China’s digital evolution offers a clear lesson: the future of marketing is not about capturing attention — it’s about fostering belonging. In a market saturated with content, brands that create communities, tell emotional stories, and prioritize authenticity will thrive.

Whether through a 15-second Douyin mini-drama, a heartfelt Xiaohongshu review, or a personalized WeCom chat, the magic happens when users feel connected — to a brand, a story, or a group of like-minded people. For global brands willing to adapt to this community-centric model, China’s digital ecosystem offers unprecedented opportunities to build lasting relationships — and drive sustainable growth.